Ether derivatives conditions could trigger sharp ETH price swing in the near future, analysts say

Quick Take

- Ether derivatives market conditions could amplify the asset’s near-future price movement, analysts say.

- Ether risk reversal trades suggest a pessimistic expectation regarding the asset’s short term price performance, analysts added.

"The market is short ether gamma, near-dated options, which means that a sharp move in either direction would be amplified," QCP Capital analysts said.

Similar conditions were detected by crypto derivatives trader Gordon Grant, who observed a sharp rise in short-dated volatility as ether recently experienced a more significant sell-off than bitcoin.

"You can see the material divergence in ether versus bitcoin. Term structure remains sharply inverted with a kink demonstrating a demand for gamma and a premium for ether gamma over bitcoin and a premium for ether gamma over ether vega," Grant told The Block.

Gamma, a mathematical expression defined as the second derivative of option premium with respect to the price of its underlier, essentially refers to the rate of change of an option's equivalent directional risk to the underlying asset's price. According to Grant, the higher gamma implies more change in that equivalent directional risk, the so called delta, with a given asset's price movement. Vega, meanwhile, is the change in the value of an option given a change in its implied volatility.

More traders are buying put options ahead of short-term expiries. According to Deribit ether options open interest data, the current put-call ratio for upcoming expirations is as high as 1.04, specifically for this Thursday's expiry. A put-call ratio above 1.0 indicates a skew towards put options, a sign of bearish sentiment in the market.

A call option gives its owner the right, but not the obligation, to buy the underlying asset and is thus a bullish bet on the asset. On the other hand, a put gives its owner the right to sell the asset and is a bearish bet.

Put options would give these traders gamma because the option's delta decreases as the price of ether falls, allowing them to profit if the price goes down.

RELATED INDICES

Ether experiencing short-term negative sentiment

QCP Capital analysts noted that indicators from ether risk reversal trades suggest a strongly pessimistic expectation regarding ether's price movements in the near future. "Ether risk reversals have turned very negative in the front-end, at -12%, indicating nervous sentiment," QCP Capital analysts added.

A risk reversal trade is a complex strategy traders use to take a position on an asset's price direction while managing the risk of adverse price movements.

The analysts added that crypto markets are getting "increasingly nervous with the downside skew in ether risk reversals sinking even deeper" in part due to macroeconomic conditions. "We expect this nervousness to persist as the Iran-Israeli conflict develops, the risk-off sentiment has been exacerbated by weakness in US equities too," QCP Capital analysts added.

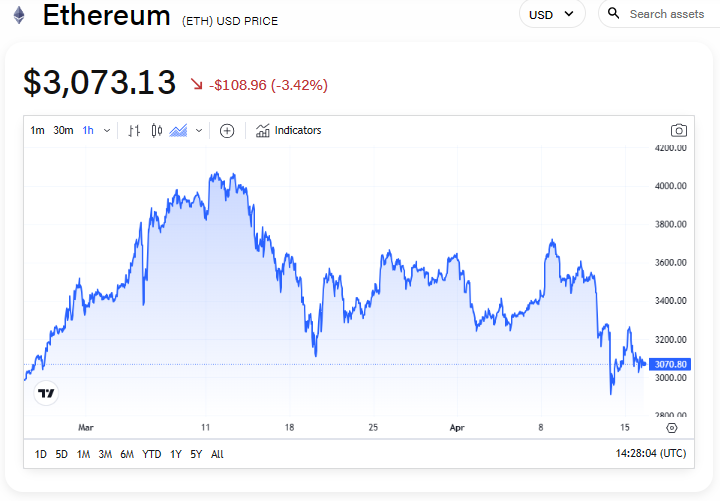

Ether decreased by around 3.4% in the past 24 hours and was changing hands for $3,073 at 10:31 a.m. ET, according to The Block's Price Page.

The price of ether fell around 3.4% in the past 24 hours. Image: The Block.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.