Franklin Templeton claims Coinbase-incubated Ethereum Layer 2 Base has 'hit a homerun' in SocialFi

Quick Take

- Franklin Templeton said the Coinbase-incubated Ethereum Layer 2 network Base is well positioned to capture a “material share” of SocialFi activity.

- The global investment manager expects Base to remain a leader in the Ethereum Layer 2 sector, which is also driven by memecoin and stablecoin activity.

Asset manager and spot bitcoin exchange-traded fund issuer Franklin Templeton said the Coinbase-incubated Ethereum Layer 2 network Base has “hit a home run” in SocialFi, driven by activity on applications such as Friend.Tech.

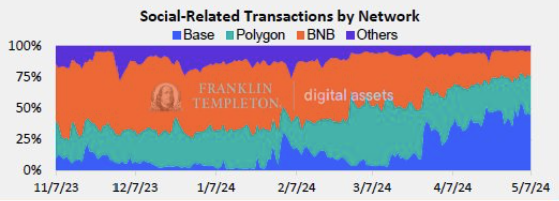

Base accounts for around 46% of all SocialFi transactions, according to a report by Franklin Templeton on Thursday — eating into the market share of Polygon and BNB Chain in the niche. Base’s activity was recently boosted by the run-up to and launch of Friend.Tech’s native FRIEND token and version 2 rollout last week.

Launched last August, Friend.Tech gained prominence with its unique, invite-only networking service that leverages social tokens called "keys" that give users access to exclusive chats and content from creators.

Friend.Tech has a total value locked of around $14 million, according to DeFiLlama data. FRIEND is currently trading for $2.23, according to The Block’s price page. It has gained 15% over the past 24 hours to reach a market capitalization of $208 million.

The combination of Base-based applications and direct integration with Coinbase’s users means the network is well positioned to capture a “material share” of SocialFi activity and remain a leader in the Ethereum Layer 2 sector, Franklin Templeton added.

Social-related transactions by network. Image: Franklin Templeton.

The Ethereum Layer 2 landscape

Base currently dominates its rivals in terms of revenue and transactions, according to The Block’s data dashboard. Base generated more than 60% ($355,000) of total Layer 2 revenue ($583,000) on Thursday.

Built on Optimism’s OP Stack, Base’s 2.5 million seven-day moving average daily transaction count is nearly five times higher than Optimism itself and one million more than the other main optimistic rollup, Arbitrum, as of yesterday.

It also leads in terms of transaction count metrics compared to ZK rollup Layer 2 alternatives.

Memecoins and stablecoins also drive Base activity

Though Franklin Templeton said SocialFi was the “key vertical” to watch in terms of adoption and growth for Base, the asset manager also attributed the rise in activity on the Layer 2 to memecoins and a significant increase in the supply of Circle’s USDC stablecoin on the network.

Base memecoins — including BRETT, DEGEN and TOSHI — have risen considerably in recent months to reach market capitalizations of $309 million, $226 million and $130 million, respectively, according to CoinGecko data. However, the tokens’ prices have dropped heavily since early April amid the broader cryptocurrency market correction.

Base has also seen the supply of USDC surge from around $100 million in December to $2.7 billion today, according to The Block’s data dashboard, reaching approximately 11% of the supply held on the leading USDC stablecoin network, Ethereum.

Franklin Templeton attributed the increase in USDC supply on Base to Coinbase’s announcement in December that it would offer free transfers of USDC on the Layer 2 using Coinbase Wallet.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.